The latest wild-and-crazy real estate market is taking bidding wars to a new level. In one city, real estate agents report getting 45 offers on one house. In another city, a Realtor reported getting more than 90! So out-of-control is demand that buyers are waiving inspections, removing contingency clauses from offers, and making offers sight unseen.

Multiple offers are coming in on the first day of listing. At showings, potential buyers are bumping into each other right and left. One house had over 200 showings in the first 24 hours, with 100 written offers following.

Here’s another case in point: A Realtor made an offer on a $230k house that was $50k above the asking price and that was considerably over appraisal as well. The asked-for inspection period was just 24 hours, and no repairs were requested. Even with all that, the offer wasn’t competitive enough, and the buyers lost out to someone else.

Our Hot Local Tampa Real Estate Market

Here’s what’s up in the Tampa-Clearwater-St. Pete housing market.

In Hillsborough County, the median sale price has been pushed to $305k, up a whopping 18% over last year. The same percentage rise applies in Pinellas County, but with a median price of $330k, as real estate is slightly more expensive there.

But here is the truly jaw-dropping number: In both counties, the months-available housing inventory is down about 71%. If all of the houses available for sale closed right now, there would literally be no homes for sale next month. The housing inventory – which has been shrinking steadily for years – is now sitting at less than one month’s worth.

If you’re still skeptical, or you think those two data points don’t tell the whole story, consider this: The average home in Hillsborough County sits on the market for just 26 days. That’s 48% less than last year’s period! The days-on-market in Pinellas County is 31, a decrease of 36%.

What’s Happening? Here’s a Snapshot

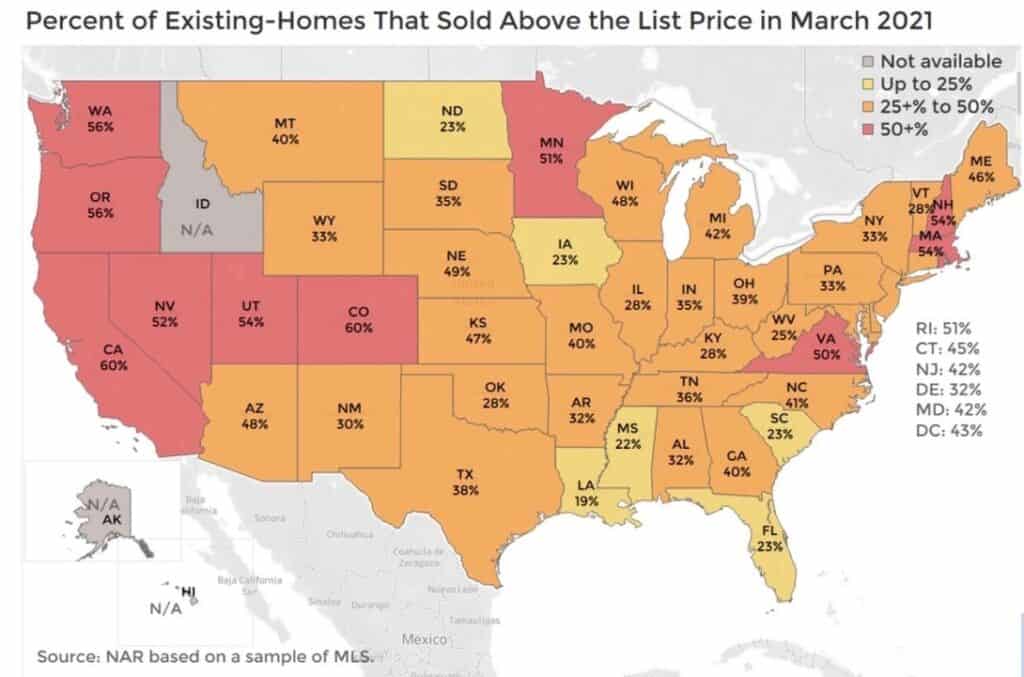

In this part of Florida, we’re not QUITE to the level of the national frenzy, where all-cash offers are sometimes the only ones that succeed. In some markets, buyers are offering to pay sellers’ closing costs. In addition, buyers are sometimes throwing in nonrefundable earnest money, even $10,000, as some buyers are desperate to finally close a deal.

So … what’s happening here? As I wrote in an earlier blog post, shrinking inventory has been a factor in the U.S. housing market for more than a decade. The great recession drove many subcontractors out of business for good, and many have never re-emerged. With new homes not being built on any kind of grand scale, existing homes are what’s left to meet demand. With the pandemic in the rearview mirror (or at least we all hope so), the surge we’re witnessing now is an almost perfect storm.

I’ve also previously noted how the pandemic changed people’s work-life expectations. Working from home means buyers are looking for bigger spaces, and commute times are less relevant than ever. COVID prompted many buyers to seek housing far away from inner-city cores, keeping demand for housing high even as other economic sectors slowed.

It goes ALMOST without saying: You need an experienced Realtor to guide you through the buying and/or selling process. With my decades in the business, I’ve pretty much seen it all – though I’ve never seen anything quite like this! I can, however, completely commit to helping you through the intricacies of a real estate closing in 2021, where avoidance of pitfalls is more crucial than ever.

Rae Anna Conforti, PA

Realtor

RE/MAX ALLIANCE GROUP

You can reach Rae Anna Conforti here.